New Vested Sale opens on TruePNL — introducing SolStreet

We are pleased to present SolStreet, a new Vested Sale to launch on the TruePNL Launchpad. The Vested Sale begins today, 23rd of May, at 16:00 GMT.

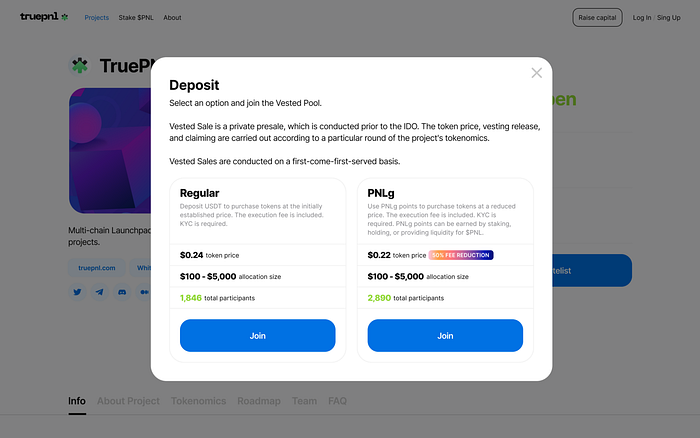

This Vested Sale will be conducted using our updated model, so our users can buy tokens with USDT or spend PNLg points to reduce the cost of the allocation.

Check out the article explaining our latest update in case you missed it here.

Now all KYC verified TruePNL users can buy their allocation using USDT or through PNLg points they’ve collected by holding PNL tokens or have received by Staking $PNL. Read more about the $PNL Staking Model here.

About SolStreet Finance

SolStreet is a Solana-based, non-custodial asset management and investment protocol that allows anyone to launch a decentralized fund directly to the market.

SolStreet is a non-custodial asset management and investment protocol built on Solana that allows asset managers and traders to launch non-custodial, decentralized investment funds directly to investors on the Solana blockchain while utilizing the deep liquidity provided by the Serum DEX.

The SolStreet protocol allows investors to deposit and withdraw funds into a smart contract (fund) that permits the asset manager to perform asset swap transactions and manage the fund portfolio, without ever being able to withdraw investor funds. This is crucial to the non-custodial nature of decentralized asset management.

SolStreet builds solutions for both Investors and Fund Managers.

The advantages for investors: only pay fees if your investments make money, allows to invest as little as users like, and get instant access to the best fund strategies in crypto and choose from a diverse set of fund strategies.

For fund managers: build funds and monetize your trading strategies, grow your assets under management (AUM), with no running costs, all while being able to trade diverse asset types.

$STRT: token use cases

The STRT token’s primary use is to govern the SolStreet Protocol, determining the usage of treasury assets and protocol parameterization, as well as helping shape the direction that which the protocol moves. Following the first two years of inflation, locking up your STRT tokens will be yield-generative, as it entitles you to a share of STRT redistribution rewards. Holding STRT gives users access to governance voting on core protocol matters including choosing which new assets to be added to the protocol, voting on improvement proposals, voting on changes to the ranking algorithm, determining the staking reward ratio, and more. Along with governance, users will be able to gain discounts on protocol fees and will receive additional performance mining rewards.

Highlights

Blockchains provide a natural solution to many of the problems facing traditional asset management.

These problems include:

- Large third-party setup costs for new asset managers. A significant portion of asset management fees goes towards paying custodians, administrators, and countless other service providers — warranting the expense of management fees.

- Slow settlement. Subscriptions and redemptions from TradFi funds can take days, weeks, or even months.

- High minimum investment amounts. Hedge funds are typically only available to high-net-worth individuals and minimum investments are typically upwards of $100,000.

- Compliance overheads. The regulatory costs associated with the distribution of a hedge fund can be prohibitively high, preventing new hedge fund entrants and hampering innovation.

- Misaligned incentives. TradFi fund managers typically profit via management fees regardless of performance and have little incentive to deviate far from the herd.

The SolStreet protocol, however, gives everyone a launchpad to create their own fund on the blockchain. Furthermore, as more and more assets are inevitably made available for trading on the blockchain (including tokenized stocks, commodities, real estate, etc.), the project offers the potential to expand to cover the entire universe of investable assets.

VCs and funds

Incubated by Invictus Capital; Seed Investors — Big Brain Holdings, Black Onyx, Nodeseeds.

Tokenomics

Roadmap

Team

More on the product, business model, team, marketing strategy, and other important details can be found in the Docs.

SolStreet Official Channels:

Vested Pool details:

💎 Pool size: $90 000

💎 Token: $STRT

💎 Min/Max investment: $50 — $500

💎 Price with USDT: $0.60

💎Price with PNLg discount: $0.55

💎PNLg Rate: $1 of the allocation equals 1500 PNLg points + 1 USDT.

💎 Listing Date: TBA

💎 Launching Platforms: TBA

🔓 Vesting: 0% at TGE, linear vesting over 4 years

Note: a fee of 10–20% is applied to this sale and included in the token price.

✅ Link to join the Vested Sale:

How to participate in the SolStreet Vested Sale on TruePNL

New options for participation using PNLg points

From now on, TruePNL users have more options to join a Vested Sale: go straight with USDT to purchase tokens, OR use PNLg to reduce the cost of your allocation. Full information can be found here.

Vested Sales are currently open to all registered and KYC verified users.

To get an allocation in a Vested Sale, you need to complete the following easy steps:

- Log in to your account and connect your MetaMask wallet

- Pass the KYC procedure

- Choose a Vested Sale on the TruePNL Launchpad

- Select the amount of allocation and buy it using USDT on Binance Smart Chain or use PNLg to reduce the cost of your allocation.

5. Your allocation will be displayed in the “My Investments” section as soon as the Vested Pool is filled and the sale of the project is closed.

6. To claim your tokens, follow our announcements with detailed instructions. The tokens are being released in accordance with the vesting scheme, which can be found on the project’s page.

Some useful links for new TruePNL Launchpad users:

- Complete Guide on how to invest on TruePNL Launchpad

- Complete Guide on Vested Sales on TruePNL Launchpad

- Buy $PNL: PancakeSwap, Gate.io, Uniswap.

- The $PNL Staking Guide

✅ Link to join the Vested Sale:

TruePNL Official Channels:

Website || Telegram Chat|| Twitter || Telegram ANN || Blog || Discord